Designing & Building

Financial Mobile Apps

In a post-COVID-19 World

White Paper

December 2022

“Banking has to work when and where you need it ...”

- Brett King

This paper addresses Fintech business owners, managers, or staff responsible for innovation in commercial banks, asset managers, and asset management firms and investors regarding:

-

The current context in the world and how to drive innovation in Fintech.

-

Strategies to build a fintech platform for mobile banking, investment, or money management.

-

The Open Banking directive and banking as a service.

-

Key components in financial app development that drives user engagement.

-

A vision for the future of mobile banking apps.

Wolfpack Digital is a financial mobile app development company that has designed and developed complex mobile banking apps such as:

-

Extra Karte - a mobile banking app for the owners of the Extra Karte credit card, allowing them to control their card, transactions, and account details.

-

Everon - is a Swiss financial mobile app that truly believes in democratizing private banking by offering access to outstanding investment opportunities that are geared to every person's needs.

-

Ikigai - combines wealth management and everyday banking in one mobile banking app.

The current context in Fintech

People need banking, not banks.

– Ranjit Sarai, President's Choice Financial

This paper uses the term “fintech” to refer to innovations in the financial and technology crossover space. The focus will be on companies or services that use technology to provide financial assistance to businesses or consumers.

In the past years, there have been several events that had a direct impact on accelerating the growth of the fintech industry. Some of them are:

As the outburst of the COVID-19 pandemic affects many industries, it has also resulted in certain beneficiaries. The technology sector, in particular, companies enabling communication and exchange of goods and services over distance, have seen notable growth.

The fintech world is no different. With the lockdown restrictions and safety measures worldwide, financial institutions that have managed to continue serving their customers through mobile apps have seen a significant increase in downloads and usage.

A 2020 research by the Swiss Finance Institute estimated that the spread of COVID-19 and related government lockdowns have led to between a 24 and 32 percent increase in the relative rate of daily downloads of finance mobile apps. In absolute numbers, this would translate into an average daily increase of roughly 5.2 to 6.3 million downloads.

At the same time, the world was already heading towards accelerated digitalization, from the online shopping of clothes or food orders to purchasing a vehicle (e.g. Tesla) - if in the past needed at least a physical auto dealer visit to buy a car, now there are more and more transactions where people buy a car without even seeing or even test-driving it before.

Although the finance industry might not have been the fastest to adapt to this trend, it has seen an upward trend over the past couple of years and is now receiving another boost with the global pandemic.

The trend is shifting from a world where you had to go to the bank to open an account to a world where you can open a bank account from the comfort of your home or even while commuting. Simultaneously, the entry barrier for investing (in assets of various kinds, e.g., stocks, bonds, etc.) is being lowered, making investment more accessible to a broader audience.

The major winners will be financial services

companies that embrace technology.

– Alexander Peh, PayPal, and Braintree

It is now easier than ever for small businesses and traditional banks to digitize their financial services. With the Open Banking regulations, such as PSD2 in the European Union, to banking-as-a-service platforms, companies can now reach go-to-market faster than before, even without requiring a banking license.

While many fintech companies might’ve hit different barriers due to past regulations, with the latest changes, the new challenges come from building a product that covers users’ needs while focusing on impressive visuals (UX/UI).

The following pages describe the steps of planning and building a fintech platform from the ground up - the challenges, the journey, and how to reach good results, concluding with a vision for the future of mobile banking apps.

Mobile Banking Apps & Digital Financial Services

- The only viable way forward

Since the COVID-19 pandemic outbreak, as nations or regions entered quarantines, people have been either not allowed or hesitant (for safety reasons) to go to physical banks. Digital banking is becoming the only viable future-proof option, and we believe the trend will not go away once the pandemic is over.

Key challenge in the 2020s will be to change the mindset in many banks from one of a finance company to one of a technology company.

– Mark Swain, Banking 2020: Transform yourself in the new era of financial services

If before the COVID-19 outbreak, just 15% of the EU employed had ever teleworked, an ad-hoc online survey from Eurofound (2020) estimated that close to 40% of those working in the EU began to telework fulltime as a result of the pandemic.

Significant companies like Twitter are announcing that they will continue to work from home entirely, even after COVID-19. Simultaneously, many big corporations and small and medium businesses are adapting their office spaces for a post-COVID world where work from home is not going to go away.

Considering all of the above, the future of fintech seems to be looking a lot more digital, with staffless bank branches (and a reduced number of branches altogether), AI, robots, and open banking.

The signs are already here. Banks are starting to close down branches - in September 2020, TBS Bank announced that it will shut down a third of its branches. Debbie Crosbie, TSB chief executive, said: “Closing any of our branches is never an easy decision, but our customers are banking differently — with a marked shift to digital banking. We are reshaping our business to transform the customer experience and set us up for the future.” (source)

Between 2017 and 2022, the number of retail bank branches is projected to drop by 36%, online banking growth statistics show.

Leanplum and Liftoff reported that after a day of signing up for a financial apps, only 34.8% of users stay. After one week, this number dropped to 14.9%, and after 90 days, it is only 3.4%. The biggest challenge comes from building an app that drives user engagement, and we believe that a premium user experience is key. According to the FIS Global 2018 survey, customers of community banks rate their app experience as falling below expectations.

-

According to a report in 2018, 75% percent of adults in the U.S. used the internet or mobile banking, which is expected to reach 77.6 percent by 2022.

-

According to a Juniper research in 2018, financial apps users will grow with a 14% YOY rate, while traditional online banking clients will only have 6% users.

-

The spread of COVID-19 and related government lockdowns have led to between a 24 & 32 percent increase in the relative rate of daily downloads of finance mobile applications.

-

By 2021 there will be roughly 7 billion mobile users worldwide.

-

USA online banking statistics show that 80% of Americans would rather bank digitally than visit a brick-and-mortar branch.

-

Financial apps and mobile banking malware crossed 50% in the first half of 2019

-

According to Insider Intelligence predictions, the revenue potential in the UK via Open Banking APIs could reach around $2 billion by the year 2024.

Strategies for Innovation

The Fintech ecosystem is at a tipping point, from startups that focus on a specific segment to established brands that focus on building modern mobile banking applications that enable multiple features and services.

Here are some of the strategies and verticals used by Fintech companies to drive innovation:

-

Focus on a specific segment

Companies that focus on a specific segment of the entire Fintech spectrum, such as KYC Compliance, AML, etc. Some of those are Subsum (focus on KYC Compliance), Futurae (Secure User Authentication), etc.

-

Banking-as-a-Service (BaaS)

Offer functionality such as opening a bank account, Peer-to-Peer transfers, and many more without needing a banking license. e.g., SolarisBank, Bankable, RailsBank, etc.

-

Switching focus to mobile banking

Switching away from physical branches entirely, only focusing on online banking. This can happen to existing companies, but we’ve also seen banks that went entirely online banking from the start without any intention to open physical branches. Minimizing customer friction by offering an online onboarding service is starting to improve the customer experience for modern banking.

-

Peer-to-Peer Transfer (P2P Transfers)

Wire transfers are complicated and take a lot of time. Instead, for small amounts, companies that adapted P2P transfers, such as Revolut, have become highly successful.

-

Focus on knowledge and education

As Fintech is entering a wider consumer market, one of the challenges is the lack of financial education (especially when it comes to investments), which can lead to a lack of trust in financial institutions/companies. The first who adopt a knowledge/educational-driven approach will not only educate the market but be the first to gain their trust.

-

Wealth Management in your pocket

Traditional Asset Management can have a big entry barrier and can be complicated, with high costs. With modern technology, that doesn’t have to be the case any longer. Platforms that manage to offer transparent wealth management at low costs, with a low entry barrier, while educating their users will win in this segment in the near future.

(e.g. Ikigai http://ikigai.money/, SigFig https://www.sigfig.com/ etc.)

-

Loans

Slow processing of loan applications and a declining rate of loan approvals, combined with a lack of transparency for the underwriting process, will incentivize the loan segment to adapt to a more competitive and transparent market.

With the use of AI, screening processes can be a lot faster - AI can monitor the customers’ financial health and future financial needs, accounts payables, and receivables.

With the Open Banking project, loans have the potential to reach a different level, with banks communicating with one another through APIs. It can make the entire analysis and risk assessment a lot quicker and the ability to take a loan fast without even going to the bank (for certain amounts at least).

-

Innovation in the SMBs segment

While all of the above strategies can be used for SMBs as well, it is a different target audience with certain needs that are different from the regular consumer market.

Some of the key needs of SMBs with regard to fintech:

- Invoicing and accounting services - invoices, integration between banking and accounting platforms - e.g., Xero, waveapps.com

- Cash flow management - e.g., fluidly.com

- Faster loans/lending.

- Budgeting.

- Payroll.

- Investments.

- Lower cost of service - lower transfer rates.

- Intuitive user interfaces.

-

Insurance.

- Payments - e.g., Stripe.

- Business benchmarking using big data and AI (e.g., https://company.sizeup.com/).

The Open Banking Project

In his 2003 book “Open Innovation: The New Imperative for Creating and Profiting from Technology” Henry Chesbrough talks about how the traditional model for innovation - which has been largely internally focused, is becoming obsolete. Instead, he proposes a concept, “Open Innovation”, which strategically leverages internal and external sources of ideas & takes them to market through multiple paths.

Much like Open Innovation, the more recent, Open Banking is shifting the attitude towards the issue of data ownership, illustrated by data regulation policies such as GDPR and concepts such as the open data movement. The banks turn into financial service platforms, and the technical concept used is Banking-as-a-Service (BaaS).

In October 2015, the EU Parliament adopted a revised Payment Services Directive, known as PSD2. The new rules included in the directive aim to promote the development and use of innovative online and mobile payments through open banking.

In August 2016, the UK Competition and Markets Authority (CMA) issued a ruling that required the nine-biggest UK banks to allow licensed startups direct access to their data at the level of transaction-account transactions.

The directive came into force on the 13th of January, 2018, and using standards and rules created by Open Banking Limited, a non-profit established especially for this task.

The CMA direction only applies to the nine largest banks alongside the broader PSD2 rules that apply to all payment account providers.

Several other countries launched open banking initiatives based on the European and UK models. These initiatives were either through industry collaboration or legislative changes. For example, in July 2019, an open-banking project was launched in Australia as part of the Consumer Data Rights project by the Australian Treasury department & Australian Competition and Consumer Commission. The Australian parliament passed the CDR legislation in August 2019.

As of January 2020, 202 FCA-regulated providers have enrolled in Open Banking. Many of them provide financial mobile apps that help manage finances and consumer credit firms that use Open Banking to access customer account information for checks and verifications.

With PSD2 regulations, banks in the EU have prepared their infrastructures for online integrations, which opens the gates to innovation for many companies.

Over 2 million users – individuals and small businesses – are using open banking-enabled mobile apps across the UK.

Banking as a Service

Banking as a Service (or BaaS for short) describes a model in which licensed banks to integrate their digital banking services directly into other non-bank businesses' products. This way, a non-bank company, such as an airline, can offer their customers digital banking services such as mobile bank accounts, debit cards, loans, and payment services without needing to acquire a banking license of their own.

BaaS providers

Key Elements for Modern Financial Mobile App Development

Among the most fascinating recent online & mobile banking statistics is the prediction that 88% of interactions between the consumer and the bank will happen through smartphones by 2022.

Building a fintech platform can have different components combined differently in apps of different kinds. Once the business model and objectives are defined, it’s time to look at how to turn those into a consumer product - more specifically, a mobile app.

Please note that we do not suggest the use of all these elements in one single app; those are simply key elements that are to be found in fintech applications of different types:

-

An overall, user-centric UX/UI Design of the app is key to driving user engagement and making your users stay.

-

Accessibility - the app should cater to all user categories and their current context. (e.g., Visual impairment, Mobility Issues)

-

Onboarding - with KYC & AML - the biggest challenge here is making the data collection process engaging to the users.

-

Advanced Security - this is the top concern for users - (for onboarding, online payments, etc.).

-

Well-Executed & Engaging User Experience.

-

Mobile Banking - account balances, transfers, etc.

-

P2P (Peer-to-Peer) transfers.

-

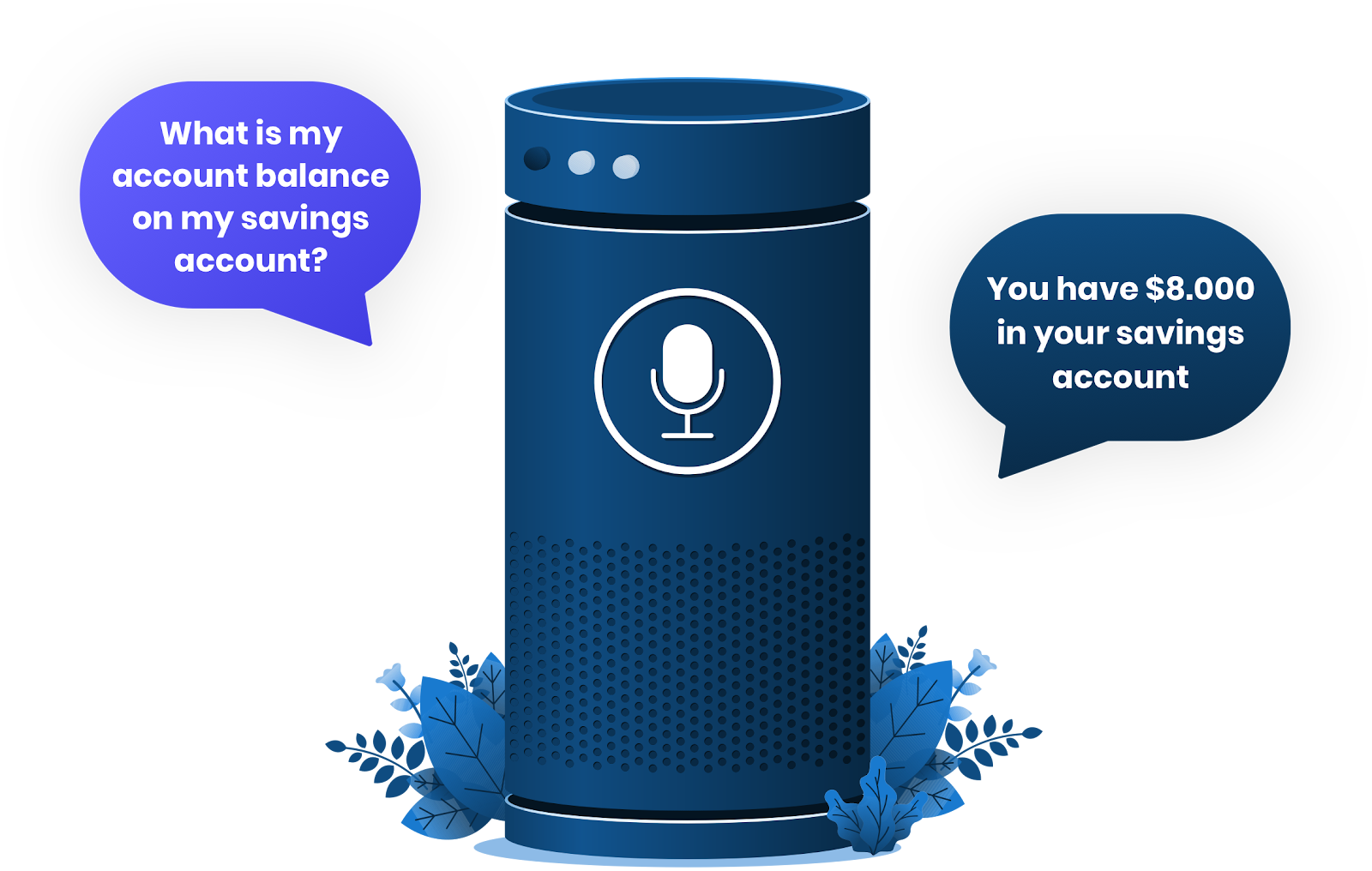

Voice mobile banking - the ability to take certain actions, such as checking your account balance or making a transfer to a trusted source via voice (using your smartphone or smart speaker).

-

Notifications and alerting systems - based on different actions or events.

-

Budgeting & Management - help users with their spending by using budgets, categorizing, and making reports.

-

Investment - users get to beat inflation and/or maximize their money’s worth by investing in low or high-risk assets.

-

In-App Customer Service - via AI-powered chatbots for basic repetitive requests that get directed to a human for more advanced requests.

-

ATM finder - although the future is looking cashless, we’ll still need cash in the near future.

-

Conversational AI - a chatbot-like interface that can make the interaction more human (can be used, for example, for onboarding).

-

Fintech for the future generation - apps for Kids - educate kids on their financials and apply parents' set limits.

-

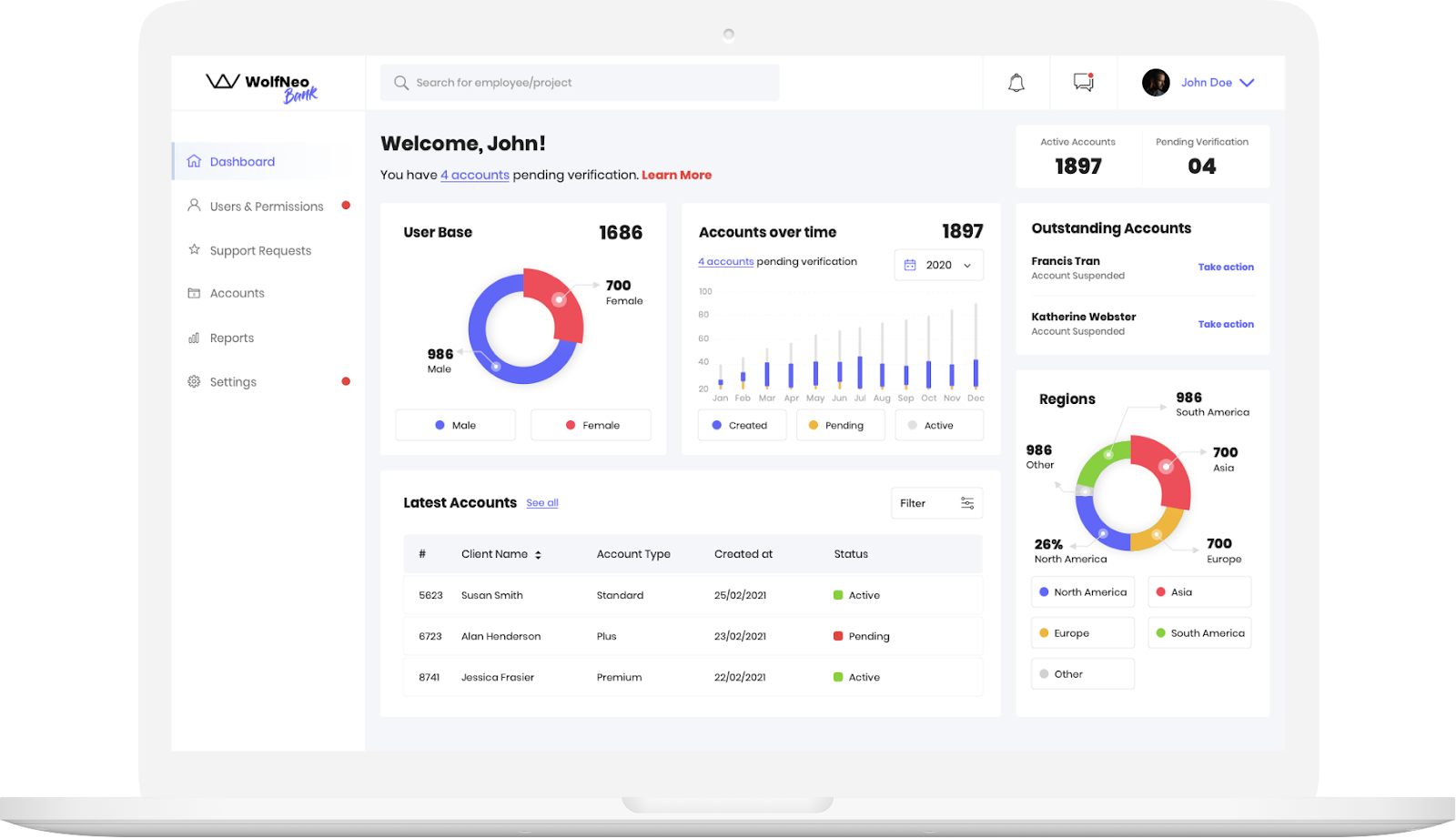

Customer Management System/Portal - used by staff or customer service to measure KPIs and manage the information.

A Well-Executed, Engaging UX/UI Design

The User Experience and User Interface of any Fintech platform are key to its success of it. The goal is to ensure that the users who are trying to complete certain tasks can do so intuitively and efficiently without any unnecessary friction.

UX/UI Design is playing a more important role than ever in the experience provided by every application, from making them more intuitive, engaging, and easy to use to interfaces designed to be secure and build trust.

A well-executed user experience builds trust.

– Tom Creighton, Wealthsimple

If you or your company are looking to design solutions with security in mind, here are a few recommended UI/UX Practices:

-

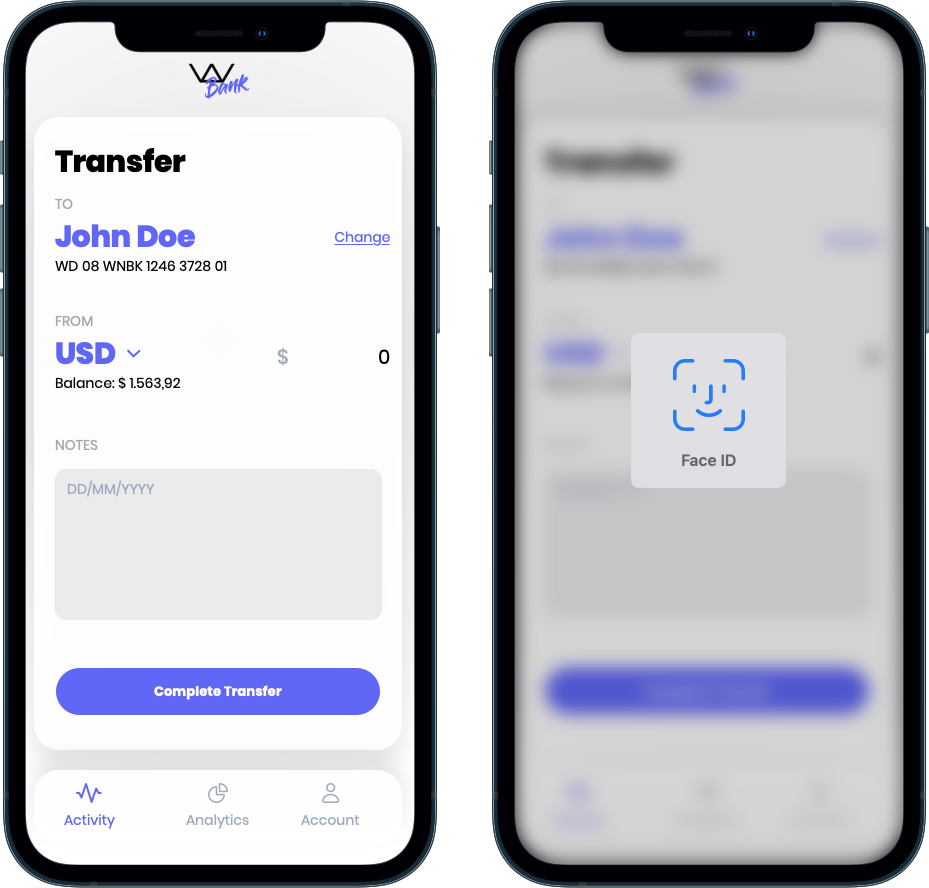

Integrate security components into the overall experience of your application. Where possible, add 2-factor authentication and extra security, including TouchID, FaceID, or voice detection.

-

Collect only the necessary data for different types of users and inform them on how it’s going to be used.

-

Inform users and ask for their consent about the meaning of any tracking feature and the purpose of using it

-

Choose intuitive over complicated or tricky navigation by cutting down any extra steps to reach a targeted action.

-

Design a simple yet secure password recovery flow with clear titles, call to action (CTAs) and real-time confirmations, and a tip of what comes next.

-

The UI should complement the UX to add a crystal clear interface and seamless experience.

-

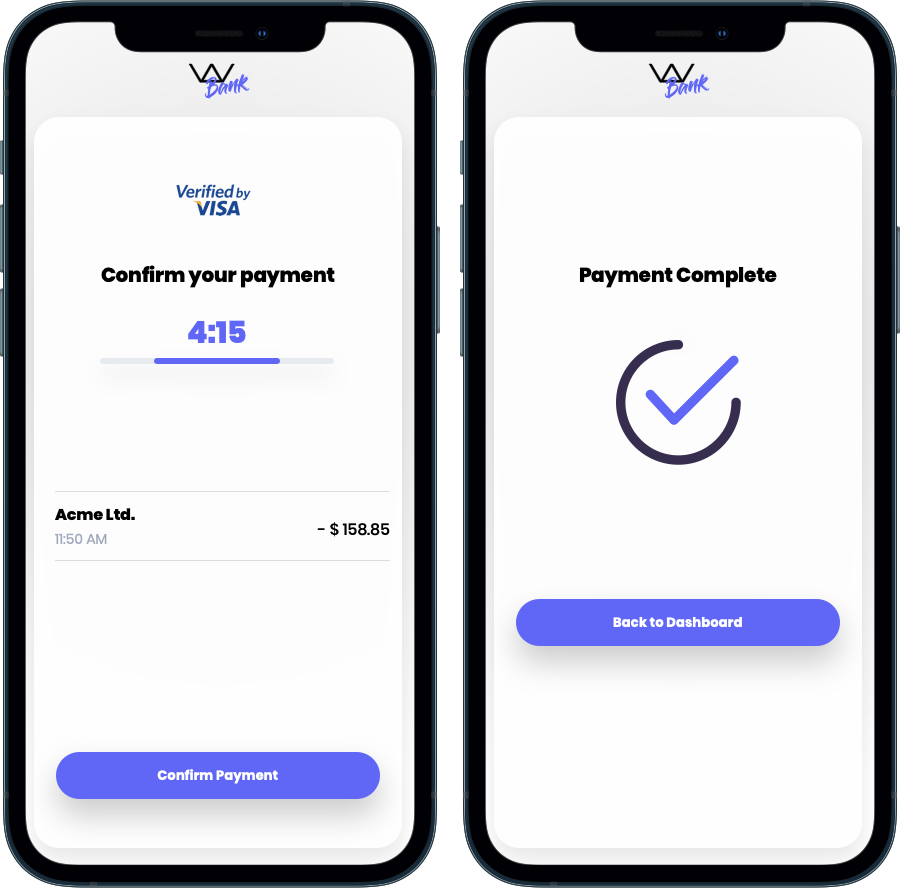

One of the 10 Heuristics of UX by Jacob Nielsen and Don Norman states that the user should be aware of the system status at all times. This can be done by including a progress bar with the steps for payments or flows that consist of multiple phases, such as onboarding, where sensitive personal information is required. It also adds predictability to the entire process.

-

Add the option to disable certain functionalities for security reasons, such as card blocking.

-

Add extra security steps that feel natural and part of the journey for important actions such as payments or transfers.

On top of that, here are a few design trends for 2021 that we recommend:

-

The rise of ethical design — The priority becomes designing for the user. This will create a more trusted view of the brand & keep your users coming back to your application.

-

More 3D elements — 3D graphics have had an increase in 2020, but in 2022/2023, it is expected that 3D elements will bring even more value to the message your brand sends & make the user’s interactions within the app more meaningful.

-

UX writing & Storytelling — To keep the same familiarity in your app, we have to be mindful of the language used. A well-written and thought-through set of labels, instructions, and content will add up to an even more engaged, easy-to-use & meaningful experience for your users.

Onboarding

The onboarding flow is, perhaps, one of the most important steps of the application. The onboarding process is one of the first contacts of the users with the application, and since it requires a big effort from them (as a lot of information is required), it needs to be engaging and give the user a sense of progress and playfulness.

Every touchpoint matters; be playful;

simplicity is strength; course-correct constantly.

– Tom Creighton, Wealthsimple

The typical onboarding flow in fintech platforms collect KYC (Know Your Customer) and AML (Anti Money Laundry) information from the customer - from basic info such as name, address, and phone number, to more confidential information such as income and source of wealth.

During this phase, it is recommended to only ask for the required information and keep the onboarding steps as few as possible. Unlocking features one by one is key here, do not ask the user for information that is needed for unlocking a certain feature in the future.

Let’s use as an example an application that has Peer-to-Peer transfer as well as Trading functionality. If the first functionality to be unlocked in the application is the Peer-to-Peer transfer, only ask for the information required to open that account initially, and when the user is ready to unlock Trading, ask for further information if needed.

As a takeaway, the onboarding process is a lengthy one and should be broken down into multiple steps as well as multiple phases, based on the services that need to be enabled.

Steps of onboarding

Basic info

This is the information needed to authenticate the user later.

This might be a good place to also ask for permissions, such as FaceID, that will be used when coming back to the application or for certain sensitive actions that require a security check - such as making a transfer.

Greeting

This is an optional step.

It’s a place where you can communicate with your users and make the experience more human.

KYC - Know Your Customer

KYC, or Know Your Customer, enables the identification and verification of customers. Identity information, e.g., personally identifiable information, is collected and checked to meet regulatory requirements and mitigate financial crime risks. KYC offers various opportunities to reduce effort duplication and enhance the customer journey.

To enhance the customer experience the use of Video-KYC and digital document verification for the authentication of the customer during the onboarding process might be a good option. Products such as IDnow (https://www.idnow.io/), Seon (https://seon.io/), or many more can help speed up the onboarding as well as the financial app development time.

AML - Anti Money Laundry

Under the ‘due diligence’ requirements, AML screening is a vital part in which identity is screened against updated criminals lists, sanction lists, Politically Exposed Persons (PEPs) records, and global watchlists. Identity inspections verify the customer in the onboarding process and check the risks of increasing financial crimes.

Security

Security is important, especially when:

-

There is a cyber-attack every 39 seconds.

-

78% of organizations in the US have experienced a cyber attack in the past year.

-

23% of Americans have either had their credit card or financial information stolen by hackers or they know someone who has.

Some of the areas in fintech platforms that need to be carefully protected:

-

Online payments - if you have a card, it is a good security measure to do an extra check by introducing a 2FA step either via SMS (with a confirmation code) or via the app, where the app can ask you to confirm the payment (e.g., BTPay)

-

Any transaction that involves money - like buying stocks in a trading platform or unlocking certain paid functionality in the application.

-

Control over the physical/digital cards in order to avoid going through call centers and chatbots. The user should have the ability to order cards, freeze/unfreeze physical cards, or generate short-term digital cards for online payments.

The good news is that the technology has evolved to offer us robust solutions for securing fintech apps, to the degree which makes it impossible for hackers to break if built properly.

P2P transfers

Sending money has to be easy - may it be that you’re at the restaurant with some friends and you’re splitting the bill, or you’re sending money to your dear ones in another country/city, it has to be easy, fast, and have a low (or no) transfer fee.

This is the era of P2P transfers, where anyone can access their phone and, in a matter of seconds, send money to someone in their address book as if they’re sending them a text message.

Some of the most common use cases for P2P transfers:

-

Request money from someone.

-

Split the billing functionality with one or multiple friends.

-

Gift card - send money to someone on a given date with a special message.

-

Recurring transfers - send money regularly.

Control over the physical/digital cards? In order to avoid going through call centers and chatbots, the user should have the ability to order cards, freeze/unfreeze physical cards or generate short-term digital cards for online payments

To keep P2P services secure, it is a good practice to:

-

Add a PIN or TouchID/FaceID verification for each transaction.

-

Encourage users to use notifications and have the application send a notification for each transaction.

-

Encourage users to send and receive money only with the people they know.

-

Link an outside account - the FDIC recommends linking a bank account or a credit or debit card when using P2P payment services. If money is misdirected, your users will have rights under federal law (in certain parts of the world) to have the error resolved. If funds are kept in P2P accounts, your users are subject to state laws and the provider’s policies, which can vary.

Mobile Banking

Although functionality such as IBAN transfers is slowly being replaced by P2P transfers in certain areas, it is still an important part of daily Mobile Banking operations.

Certain banks choose to offer both P2P as well as IBAN transfers in their Mobile Banking application.

The most common and most used functionalities of modern Mobile Banking applications:

-

Easy way to see account balance - it has to be easy to access and secure to protect your financial information.

-

Easy way to see account history - the ability to see your past spending and group them into categories.

-

Easy way to do IBAN transfers.

-

Open new accounts - whether it’s a different currency account or a savings account, it has to be fast to open new accounts.

-

Block your cards or request a new card.

Additionally, Mobile Banking features that can be helpful in the financial mobile app development process:

-

Pay your bills by scanning a barcode.

-

Export account history sheets.

-

ATM locator.

-

Overview and management of loans.

-

Push notifications for payments or incoming transfers.

-

Stocks trading.

-

Opening of asset management accounts.

-

Budgeting and money management.

Budgeting and money management

Budgeting functionality can help you control your spending and help with your savings.

Whether you want to save up for a car or for your child’s university fees, ideally, budgeting should not be there to restrict you but rather help in achieving certain financial goals.

This works best as a functionality together with the mobile banking or P2P feature, as you won’t have to import any information about your spending from another application, but there are some very well thought platforms that do this independently.

Investment

Opening traditional asset management accounts has a rather big entry barrier. Technology is here to change that. With the modern digitalization of this segment, it is now possible to decrease the entry barrier and allow things like purchasing fractions of a share (e.g., Revolut).

We believe that this is one of the most complex parts of Fintech, with the highest level of risk; it is recommended to make sure that your platform is educating the users when it comes to asset management.

This can be wrapped into a nicer package without having to use the financial jargon that the majority of the customers might not easily understand. As an example, based on your risk assessment, an investment platform might choose the right assets or asset combinations that are right for your profile (e.g., 80% low risk - bonds, 20% high risk - stocks).

A more playful strategy is the one that Acorns uses in its Round-Ups feature. Each transaction is rounded up, and the difference between the rounded-up amount and the paid amount is automatically invested for you. e.g., if you’re purchasing $ 19.8, $ 0.2 will be invested for you.

Chatbots

AI-based chatbots and chatbot-like interfaces make the user experience a lot more personalized, enhancing relationships with the customers. This can also allow for 24x7 customer service, quickly resolving customer queries, reducing manual tasks, and generally faster response time, resulting in higher customer satisfaction.

According to certain projections, by 2022, more than 90% of banking interactions will take place via chatbots. Human-less inquiry resolution benefits have already been reflected by services like Corporation Bank online and SunTrust Bank online personal banking.

.

.

Voice Assistant

By the end of 2020, it is forecasted that there will be 4.2 billion voice assistants, and by 2024 the number of digital voice assistants will reach 8.4 billion units - a number that is greater than the world’s population.

With the speedy market share increase of the new speakers with virtual voice assistants such as Apple Siri, Amazon Alexa, and Google Assistant, people are starting to do their shopping by voice.

67% of smart speaker owners in the USA are comfortable making financial transactions through voice banking. Most of them are also online and mobile banking users.

At the same time, in a normal, non-COVID period, many people spend time in their car commuting. The average American commute reached 27 minutes one way in 2018. This allows time to take care of any financials while in your car, using voice assistants.

May it be checking your account balance or making certain payments, voice assistance will be a big thing in the near future in the Fintech industry.

Financial dashboards and user management

Although a component that is most likely not customer-facing, instead used by staff, having a dashboard for customer support or various staff members to check transactions, accounts, etc. is equally important to have a customer-facing application.

The core functionality of the dashboard could be:

-

Accounts management.

-

Account flagging - might require a human to make the final decision.

-

Customer Service Dashboard

-

Business KPIs dashboard - daily subscriptions, income statistics, active users, etc.

Loans

With the use of Artificial Intelligence (AI), bank loans can become fairer. Historically, there have been biases against protected characteristics, such as race, gender, and sexual orientation. Relying on AI to make credit decisions instead of using human judgment can fix that.

On top of that, AI can make for a much more accurate risk analysis, where the risk for the banks might also decrease.

On the other hand, in the SMBs world, the leading competition for SMBs is not about interest rates and fees, as you might think, but it’s about speed, transparency, and the likelihood of approval.

Banking for SMBs

SMBs are less than happy with the service they receive from their online or mobile banks. According to a FIS Global study, the dissatisfaction is correlated with SMBs' indication that their bank's digital offerings are poor.

SMB owners from all generations express a general frustration with the amount of time they spend managing their day-to-day finances and obtaining loans when they want to focus on their products and customers.

Further, only 32% of SMBs feel that their bank understands their business. The following are key challenges and points of dissatisfaction expressed by SMB operators:

-

Managing a positive cash flow.

-

Slow processing of loan applications

-

Siloed customer service units and slow issue resolution.

-

Effort and lag time when processing invoices and payments.

-

Lack of customization of banking applications and processes to match preferred behavior.

-

Limited insights into their financial needs and optimal growth strategies

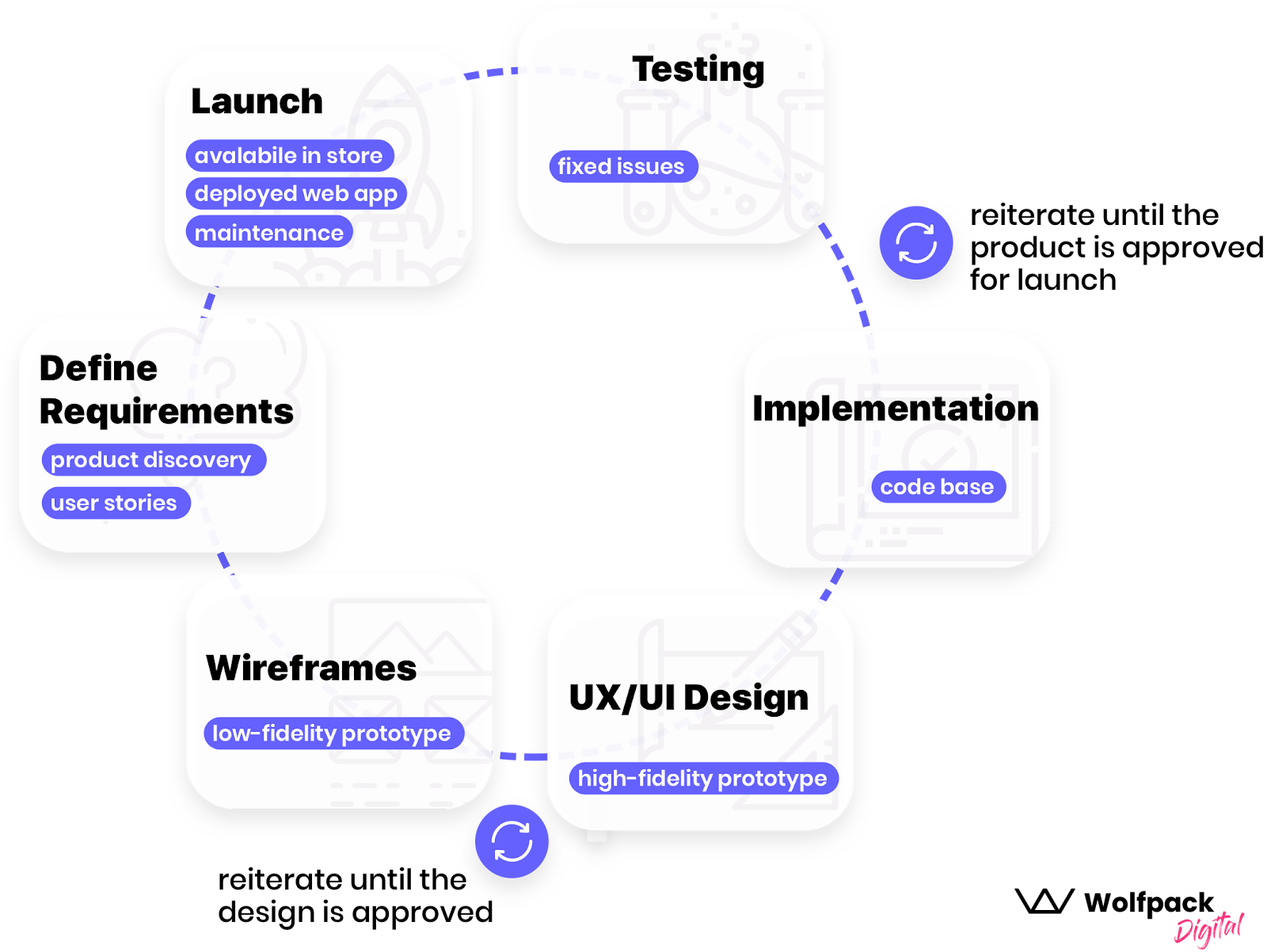

The Process for building mobile banking apps

When it comes to the actual building of a Fintech platform, it is essential that modern and Agile processes are being used, to adapt to an ever-changing world.

We recommend an Agile Approach using SCRUM, composed of the following steps:

-

Define requirements - what you want/what the user wants/needs.

-

Wireframing - visual sketch of the components.

-

UX/UI Design - dress up the wireframes with a nice and practical design and define the entire user experience.

-

Development and QA - implement it, considering performance, security, and quality.

-

Release - release it to the public - ideally to a smaller audience under a BETA release, then to the wider audience.

-

Get feedback from users & iterate - there will be things that users wished they were different or they wish for additional functionality, re-iterate using the same process to improve the product in multiple iterations.

Choosing a financial app development company

Financial mobile app development has its particular challenges that require specific domain knowledge. When looking for an app development company, it's important to consider their experience and expertise in developing financial mobile apps. Financial apps require specific skills and knowledge that not all developers possess.

It is worth doing some research and asking questions about the team’s financial development capabilities before signing any contracts with them. Ask for references, look at portfolios and case studies, and make sure they have experience in financial application development. A financial app development company with the right skills and experience can help your financial mobile application reach its full potential.

A future vision for financial apps

Here are a few key components that we believe will be widely used in the near future:

-

Apple Pay & Google Pay for store as well as online transactions from you phone or smartwatch, as well as your computer.

-

Easy goals-based investments - without the need to understand how stocks or bonds work in the highest level of detail.

-

Physical vendor payments without POS - small vendors will not need a POS to receive contactless payments, they might have an app on their phone, and using a QR code or similar the user will be able to pay for their purchases from their own phone.

-

Educational material - especially on investment, will educate the users and allow them to trust asset management platforms.

-

People will want to manage their savings themselves, with easy-to-access and controlled asset management, this will be possible, but like they say “With great power comes great responsibility”, investing in educating your users will bring value in the long term.

-

Saving and investing for the long run - managing and having an overview of the 2nd or 3rd Pillar (pensions) via mobile platforms.

Conclusions from a financial app development company

In this paper, we’ve looked at the current Fintech context, how it has been affected by COVID-19, and why the industry is at a tipping point.

We’ve also gone through some of the current regulations that have a positive impact on fintech companies and looked at strategies for innovation together with some of the key components of a fintech mobile application/platform.

Key takeaways

-

The current context in the world is favorable for Fintech companies.

-

Open Banking will help accelerate the digital transformation in Fintech.

-

Banking as a Service can help many companies speed up the process of releasing a Fintech platform.

-

A well thought, and well-executed UX/UI Design is essential for driving user engagement.

-

We’ve explored a set of key components and features that can help you get started on your fintech platform or might help adapt an existing one.

-

To overcome all challenges as well as drive innovation, an Agile process is a must.

Appendix: Research sources

Although, in this paper, we are sharing our expert knowledge from our experience with building Fintech platforms, here are some of the key research materials that we’ve used: